Mastering Holiday Financial Planning

The holiday season is a time of joy, celebration, and togetherness. However, it can also bring about stress, especially when it comes to managing finances. For menopausal career women, careful financial planning is not just about preserving holiday cheer but also ensuring health and well-being. Here’s how you can enjoy a festive season without the financial strain.

1. Create a Budget and Stick to It

The first step in managing holiday finances is to create a budget. Outline all your expected expenses, including gifts, decorations, travel, and holiday meals. Allocate a specific amount for each category and ensure you stick to it. Remember, it’s the thought that counts, not the price tag.

2. Prioritize Self-Care

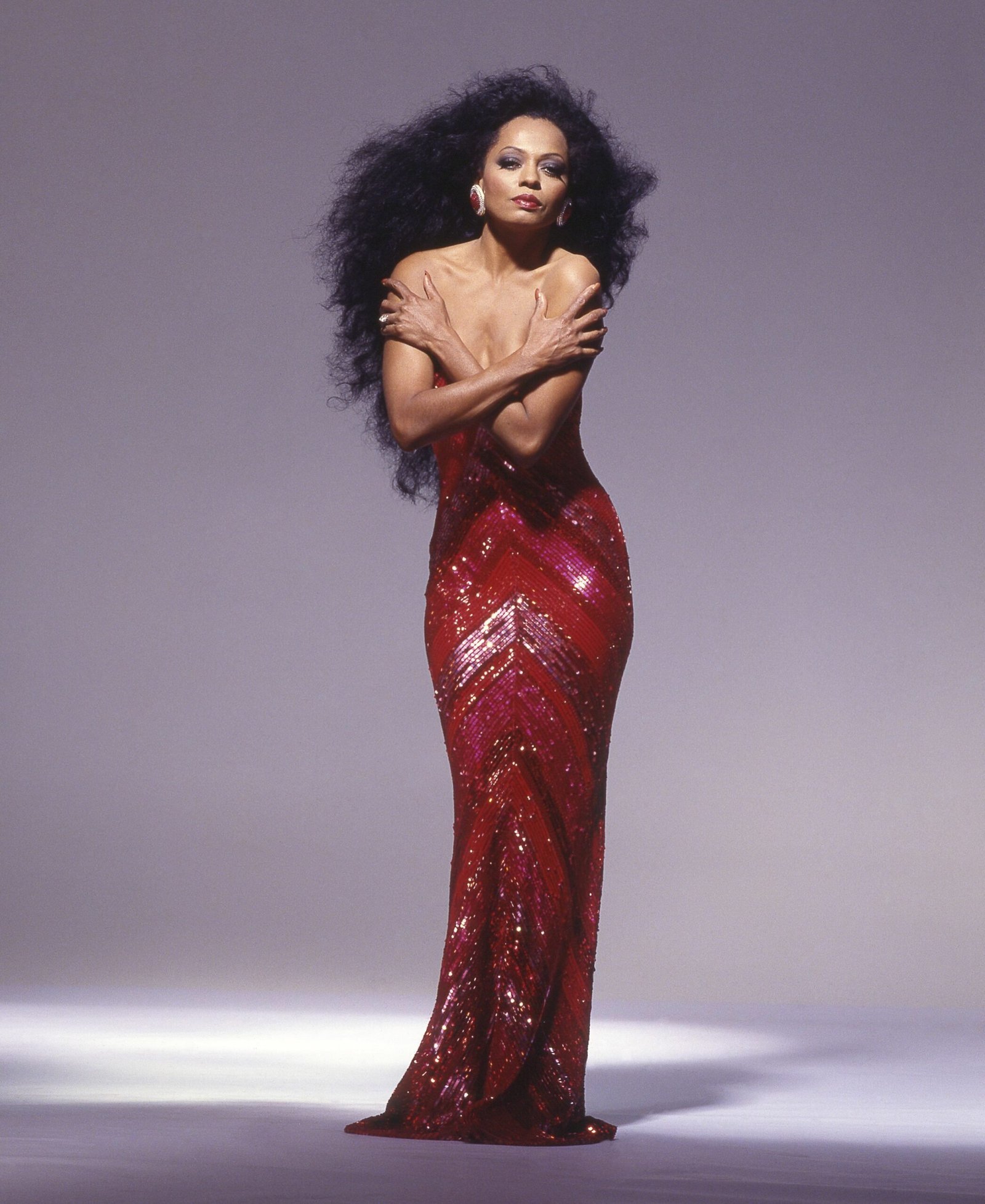

Menopausal symptoms can be exacerbated by stress, so it’s crucial to prioritize self-care. Allocate a portion of your budget to activities or items that help you relax and maintain your well-being, such as a massage, yoga class, or Jill Denise’s temperature-regulating clothing that can help manage hot flashes.

3. Plan Your Shopping Early

Last-minute shopping can lead to impulsive buying and overspending. Start your holiday shopping early to take advantage of sales and discounts. Make a list of recipients and potential gifts to avoid unnecessary purchases. Online shopping can also offer better deals and convenience.

4. Embrace Homemade and Thoughtful Gifts

Handmade or personalized gifts can be more meaningful and cost-effective than expensive store-bought items. Consider baking cookies, crafting ornaments, or creating photo albums. These gifts often hold more sentimental value and show your care and effort.

5. Limit Credit Card Use

Credit cards can be tempting during the holiday season, but it’s essential to use them wisely. Avoid maxing out your cards and try to pay off balances quickly to prevent high-interest charges. Consider using cash or a debit card to keep spending within your budget.

6. Take Advantage of Year-End Bonuses

If you receive a year-end bonus, use it wisely. Allocate a portion to cover holiday expenses and consider saving or investing the rest. This can help reduce financial pressure and provide a buffer for future needs.

7. Set Realistic Expectations

The holiday season can come with high expectations, but it’s important to keep them realistic. Communicate with family and friends about your budget constraints. Most will appreciate your honesty and understand that the holidays are about spending time together, not lavish gifts.

8. Look for Free or Low-Cost Activities

There are plenty of ways to enjoy the holiday season without spending a fortune. Look for free community events, holiday light displays, or host a potluck dinner with friends. These activities can create lasting memories without breaking the bank.

9. Avoid the Holiday “Comparison Trap”

It’s easy to compare your holiday plans and spending to others, especially with social media’s influence. Remember that everyone’s financial situation is different, and it’s okay to celebrate in a way that fits your budget. Focus on what brings you joy and fulfillment.

10. Plan for the New Year

As the holiday season winds down, start planning for the New Year. Review your financial goals and make adjustments as needed. Establish a savings plan to cushion unexpected expenses and set realistic financial resolutions to keep you on track throughout the year.

By implementing these strategies, menopausal career women can navigate the holiday season with financial confidence and peace of mind. Careful planning not only helps manage stress but also ensures that you can fully enjoy the festive season with loved ones. Remember, the spirit of the holidays is about connection and joy, and with thoughtful financial planning, you can create a season filled with warmth and happiness.