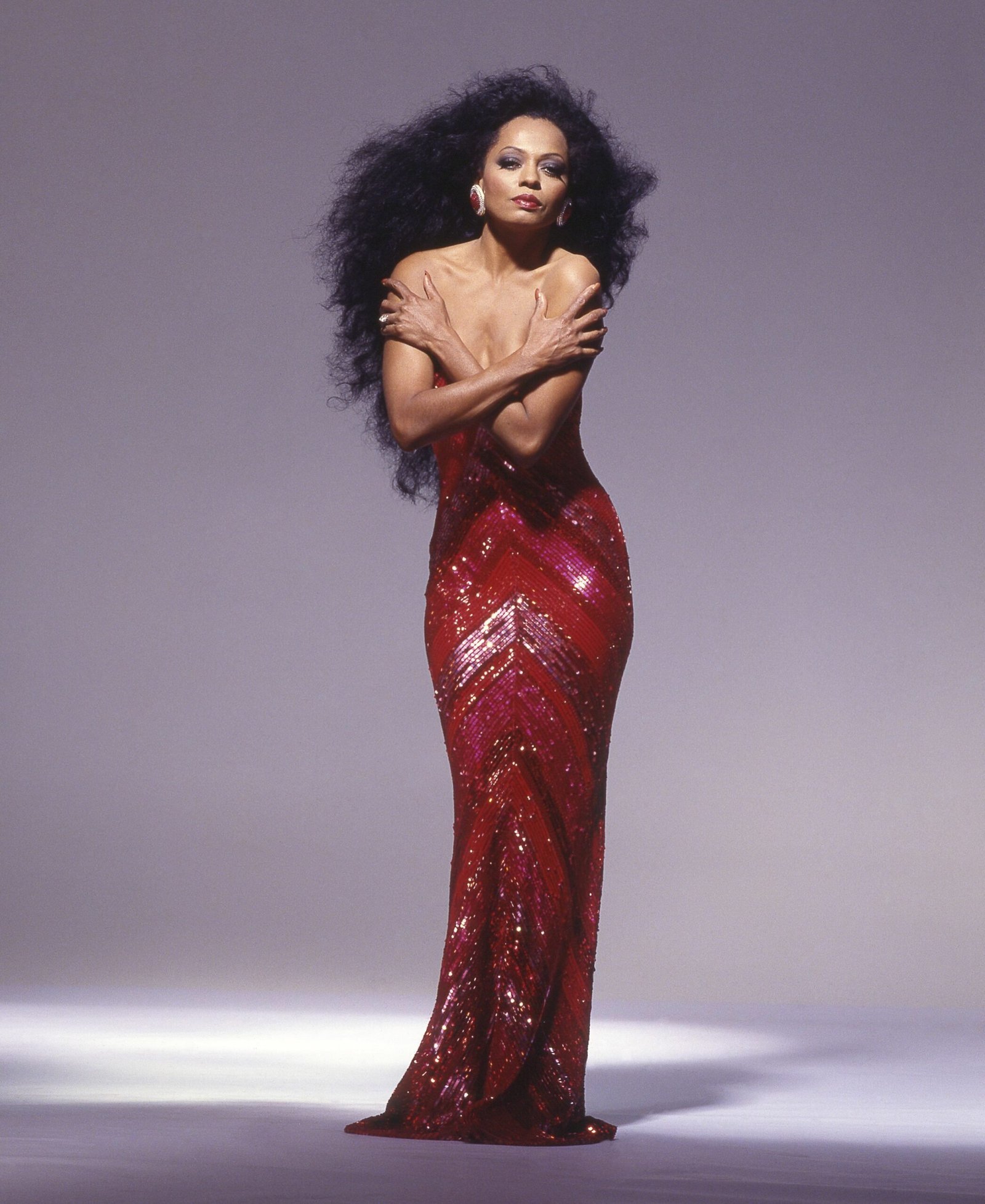

Smart Money Moves: Avoid These 7 Financial Pitfalls After 50

Navigating the financial landscape in your fifties can be complex, especially as you approach retirement and aim to solidify your financial future. While you may have amassed a wealth of experience and knowledge, it’s crucial to be aware of common financial pitfalls that can derail your plans. Here are seven key financial pitfalls career women age 50+ need to avoid:

1. Underestimating Retirement Needs

One of the most significant financial mistakes is underestimating how much money you’ll need for retirement. With increasing life expectancy, your retirement could last 20-30 years or more. It’s essential to:

- Accurately estimate expenses: Consider healthcare, housing, travel, and lifestyle costs.

- Adjust savings plans: Ensure you’re contributing enough to your retirement accounts to meet these needs.

2. Ignoring Healthcare Costs

Healthcare expenses can be a substantial financial burden as you age. Overlooking these costs can jeopardize your financial security. To avoid this pitfall:

- Invest in long-term care insurance: This can cover services that aren’t included in standard health insurance.

- Build a health savings account (HSA): If you’re eligible, an HSA offers tax advantages and can help cover medical expenses in retirement.

3. Relying Too Heavily on Social Security

While Social Security is a valuable source of income, it shouldn’t be your sole financial plan. The average Social Security benefit may not cover all your expenses. To ensure a comfortable retirement:

- Diversify your income streams: Include pensions, retirement accounts, and other investments.

- Maximize Social Security benefits: Delay claiming benefits until age 70 if possible to receive the highest monthly amount.

4. Neglecting Estate Planning

Failing to plan for the distribution of your assets can create significant legal and financial issues for your heirs. Effective estate planning ensures your wishes are honored and can minimize tax burdens. Key steps include:

- Drafting a will: Clearly outline how you want your assets distributed.

- Establishing trusts: Consider trusts to manage and protect your assets for future generations.

- Updating beneficiaries: Regularly review and update beneficiary designations on accounts and insurance policies.

5. Overlooking Inflation

Inflation erodes purchasing power over time, meaning the money you have today won’t stretch as far in the future. To safeguard against inflation:

- Invest in inflation-protected securities: Consider Treasury Inflation-Protected Securities (TIPS) and other investments that adjust with inflation.

- Maintain a diversified portfolio: Include assets like stocks and real estate that historically outpace inflation.

6. Taking on Too Much Risk

While some level of investment risk is necessary to grow your wealth, taking on too much risk can be detrimental, especially as you near retirement. To manage risk effectively:

- Assess your risk tolerance: Reevaluate your risk tolerance and adjust your portfolio accordingly.

- Diversify investments: Spread your investments across various asset classes to reduce risk.

- Seek professional advice: Consider working with a financial advisor to develop a balanced investment strategy.

7. Failing to Plan for Longevity

Living longer than expected can strain your financial resources. It’s crucial to plan for a long life to ensure you don’t outlive your savings. Strategies include:

- Creating a comprehensive financial plan: Account for the possibility of living into your 90s or beyond.

- Adjusting withdrawal rates: Use a conservative withdrawal rate from your retirement accounts to preserve your savings.

- Continuing to work: If possible, consider part-time work or consulting to supplement your income and delay full retirement.

Conclusion

By being aware of these seven financial pitfalls, career women age 50+ can take proactive steps to secure their financial future. Proper planning, diversified investments, and continuous financial education are key to avoiding these common mistakes. As you navigate this important phase of life, remember that careful financial management today will ensure a more secure and enjoyable retirement tomorrow.